Last year the number of investments in data center globally had a strong growth, with a number of transactions that reached 117 units in 2021, scoring an annual increase of 64%, and doubling the value of investments up to USD 59,9 billion. These are the results of a report by the DLA Piper International law firm, titled ‘The meteoric rise of the data centre: key drivers behind the global demand’. This extraordinary growth is expected to continue, as in the first half of 2022 there have been already 41 transactions worth USD 21,3 billion, which doubles the USD 10,6 billion total of the same period in 2021.

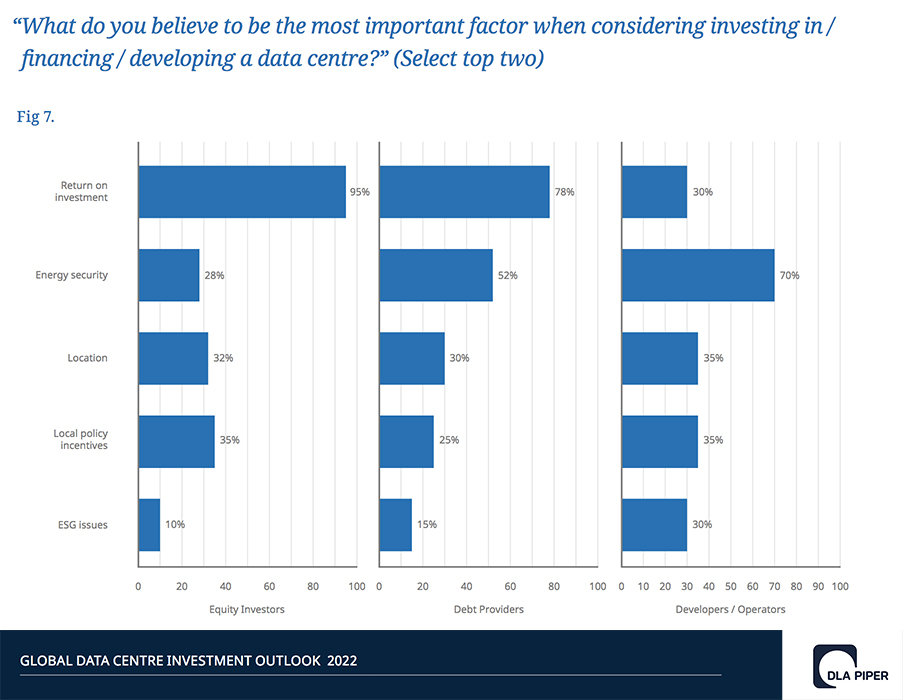

Even more interesting on the perspective of Tempco is the growing focus that investors, debt providers and developers have on energy security and ESG issues related to data center infrastructures. The global growth of data centers is clearly driven by the increasing demand for cloud services, and by the rise of IoT and artificial intelligence applications, with also the incoming rollout of 5G connectivity and the dawn of Metaverse. At the same time, the regulatory scrutiny and intervention in ESG have been increasing, with initiatives such as the Climate Neutral Data Centre Pact and metrics like PUE (Power usage effectiveness) more and more weighing on requirements for data centers around the world.

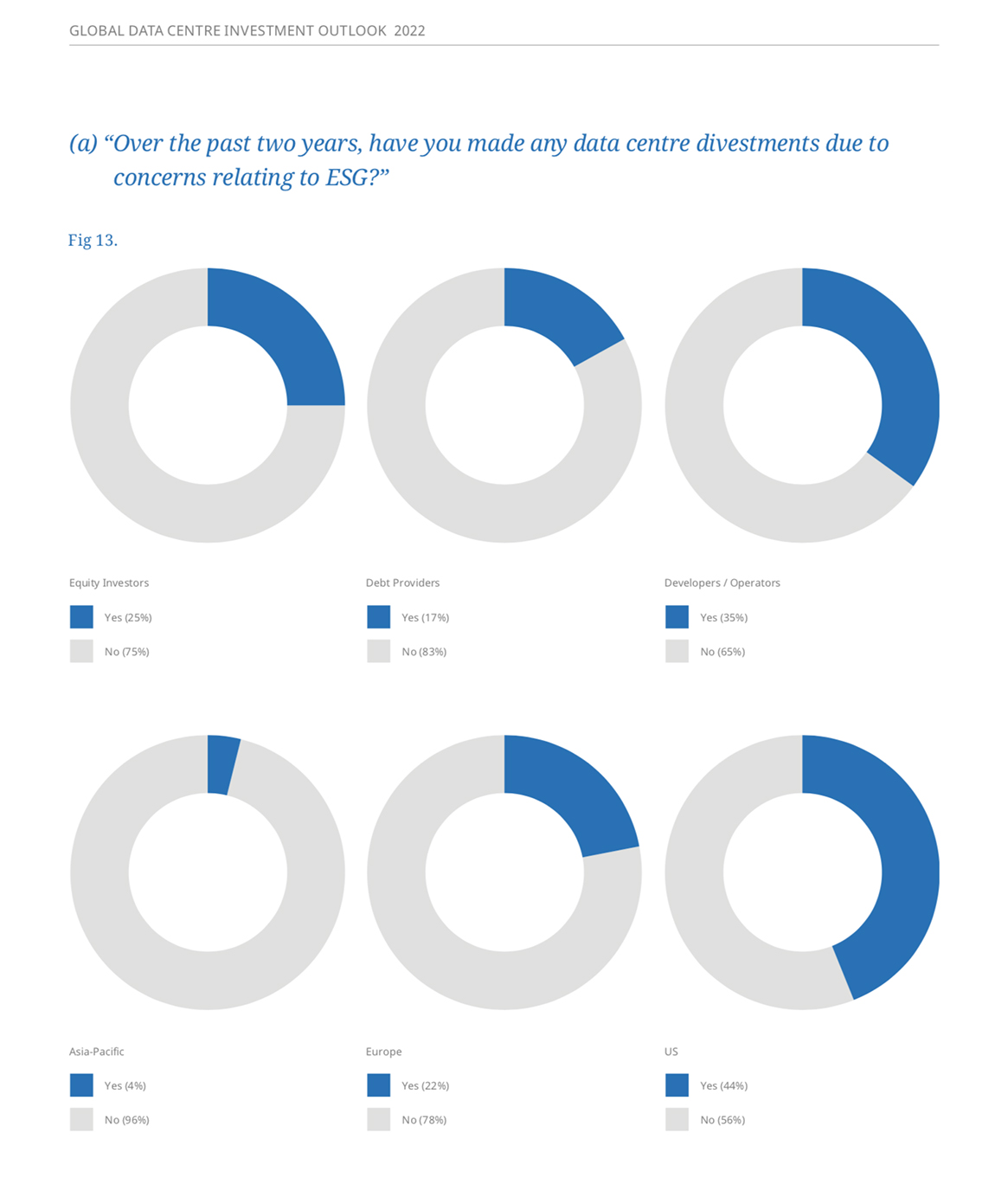

In this context, almost all respondents (94%) said that scrutiny and diligence surrounding ESG issues increased when making data center investment and/or development decisions in the past 24 months, and 99% of them anticipate a further increase in the next 24 months. More than a third (35%) of developers/operators said that they divested at least one data center in the past two years due to concerns related to ESG. The survey also shows that net zero carbon emissions are firmly on the agenda for a majority of respondents, as 68% of equity investors and 60% each of both debt providers and developers/operators said that the data center in which they had most recently invested either has a target to achieve net zero emissions by 2030 or it had already achieved this. Finally, energy and ESG factors are top drivers when it comes to generating a premium for data center investments: 70% of developers/operators and 75% of both debt providers and equity investors said they would be glad to pay a premium to invest in or finance a site with very good to excellent ESG and sustainability credentials.

As in topics we have already treated in the past, sustainability and energy saving in data center notably refers to the switch from air cooling systems of IT equipments and electronics to liquid cooling solutions, taking all of the advantages provided by immersion cooling in data centers. This represents in fact a shift gears for data centers, towards a more sustainable and green future for IT computing infrastructurea with a lower environmental impact. There are indeed several advantages offered by liquid cooling of data centers equipment, starting with the possibility to employ cooling fluids at higher temperatures thanks to the higher heat dissipation rate of liquid compared to air. Great energy savings are then also due to the elimination of fans and compressors in chillers, and furthermore allowing the implementation of free cooling systems.